The Ultimate Guide to Funko Daria NFTs

Join Droppp on July 2, 2024, at 11 AM PT / 2 PM ET for the launch of Funko Daria NFTs. Includes limited edition Funko Pops to collect!

Blur compares its new peer-to-peer NFT lending platform with the mortgage market. Is this a misguided parallel or reckless disregard?

Blur, the current market-leading NFT marketplace, recently announced a new peer-to-peer NFT lending platform: Blend.

Blend allows users to borrow and lend using non-fungible tokens (NFTs) as collateral.

Lenders can offer loans with their chosen interest rates and terms, while borrowers can repay the loans or face the liquidation of their NFTs if the lender decides to exit the loan.

The key features of the Blend platform are:

Examples of such arrangements are the ability to borrow up to 42 ETH against your Crypto Punk or buy that typically out-of-reach 15 ETH Azuki for only 2 ETH (with a 13 ETH loan).

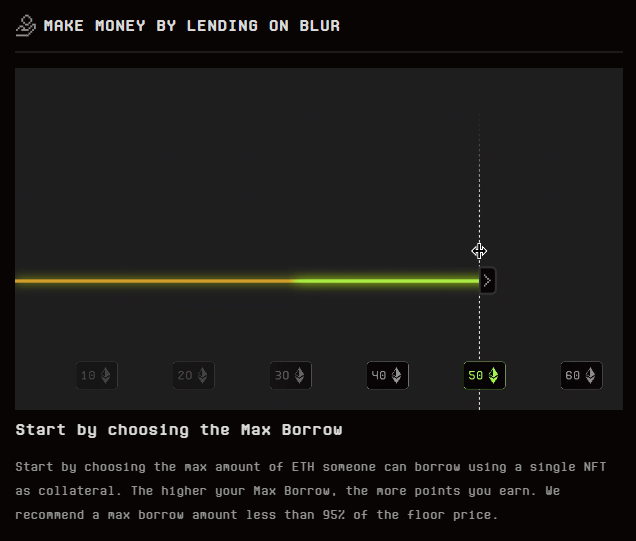

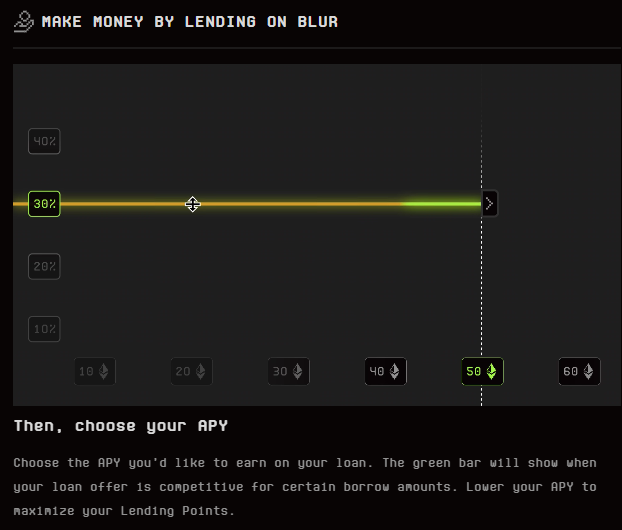

Lenders simply select their Max Borrow, their APR and start earning when the loan is accepted by a user, locking the NFT until the loan is repaid.

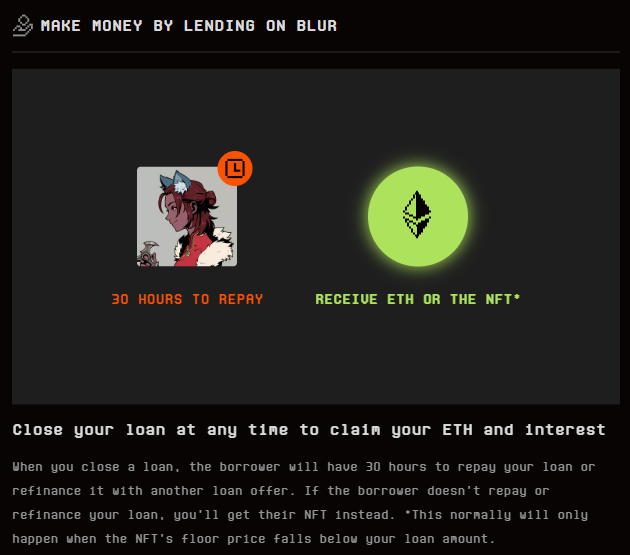

When a lender wants to close the loan, they can do so at any time to claim the ETH loan back and interest. The borrower has short 30 hours to repay, either through self-funding or refinancing.

If they don't repay within 30 hours, the lender takes possession of the NFT.

Blur bizarrely compared their new Blend platform to mortgages, stating that "every trillion dollar market relies on financialization to scale. NFTs are no different".

4/ Every trillion dollar market relies on financialization to scale. NFTs are no different.

— Blur (@blur_io) May 1, 2023

Instead of paying $1m for a house, buyers put $100k down and pay the rest through their mortgage. Without this mechanism, almost no one would be able to afford homes. pic.twitter.com/4J96G3pGnJ

Comparing Blend to mortgages presents an intriguing analogy; however, upon closer examination, this comparison falls short of capturing the true nature of the platform.

The attempt to instil confidence in potential users by drawing parallels to a familiar financial instrument, such as mortgages, may even be considered reckless.

The risks associated with NFT investing differ significantly from those of traditional mortgage lending, and it is essential to acknowledge and understand these distinctions rather than relying on superficial similarities.

Aside from collateral-backed loans, liquidation of the collateral and interest rates, there are very few similarities.

It could be argued that Blur's comparison of Blend to mortgages was simply an attempt to convey the idea that financial instruments are necessary for scaling. It certainly will provide liquidity and encourage transactions that otherwise wouldn't be possible.

However, using mortgages as an example is certainly at the least misguided, as it does not accurately reflect the risks and nuances involved in the Blend platform, and could potentially mislead market participants into a false sense of security.

Blur's Blend platform certainly has the potential to create a speculative bubble, with the likely many ill-informed market participants on both the lending and borrowing sides, which could result in a panic-driven collapse when the bubble bursts.

In reality, the Blend platform presents a host of risks to both lenders and borrowers that are significantly different from those associated with traditional financial tools such as mortgages.

While the concept of Blend's peer-to-peer NFT lending platform may appear intriguing and even groundbreaking, one could argue that it is simply another form of gambling disguised as a financial tool, potentially encouraging reckless behaviour among untrained market participants.

As the NFT market continues to evolve and mature, it is crucial for all parties involved to tread carefully and consider the potential risks in this speculative space.

Would you mortgage a house of cards?